Congratulations! You decided to buy a home and look towards figuring out the next steps in the process. You know you need to secure a mortgage but are overwhelmed with the process. You get your financials in order, check your credit report, research different loan rates, and decide where and how to apply for a loan. That’s where choosing between a broker and a lender comes into play. It’s also where you have asked the question; what’s the difference?

Mortgage Broker

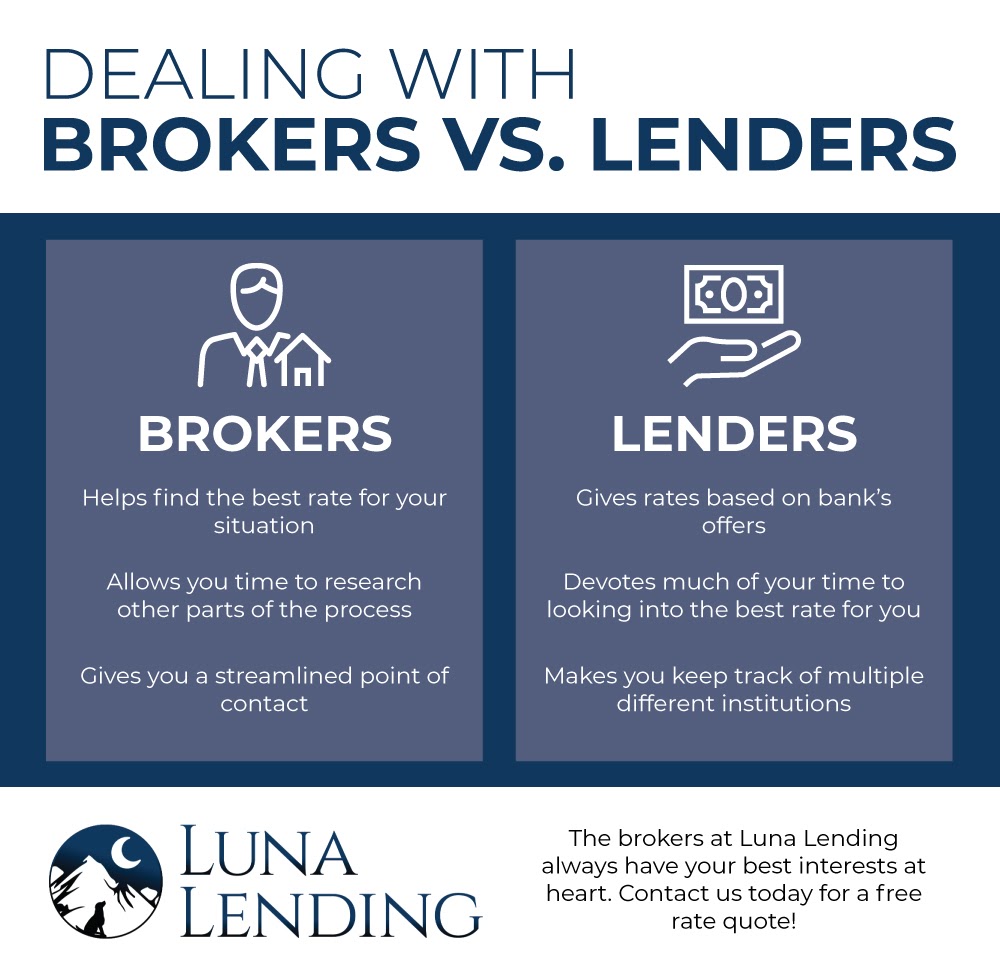

A mortgage broker acts as the intermediary between you and the lender. Brokers will do the leg work on finding the loans and rates that make the most sense for your financial situation. They help take some of the pressure off of you so you can focus on other aspects of the home buying process. While you can do your research into different interest rates in your area, a broker, like those found at Luna Lending, can call attention to information that can help narrow down your search for the perfect loan. Utilizing a broker means dealing with a single point of contact instead of contacting multiple lenders to learn about their specific loans.

Direct Lenders

Direct lenders are the financial institutions that offer mortgages. The majority of direct lenders are banks or savings and loan associations. If you are dealing with direct lenders instead of going through a broker, you can apply to multiple lenders for a mortgage and then parse through the offers to find the one that is best for you. You can keep track of which lenders you have applied with and develop contingency plans if any of them fall through or a better deal comes along.

The Difference for You

The main differences between a Mortgage Broker and Direct Lenders come down to the point of contact. How many different people or institutions do you want to keep track of during the application process? Dealing with more lenders can lead to the unwanted additional stress of keeping track of multiple applications, researching numerous banks, and trying to keep everything straight. By utilizing a broker, you have someone in your corner that has your best interests at heart and help you find the best mortgage that is right for you and your family.

Are you interested in starting the home buying process in the Tahoe area? Contact Luna Lending for a free mortgage rate quote today!

AHL is an Equal Housing Opportunity Broker.

NMLS: 134718 | CalDRE 02067377 | NV 65339 | CO 100055620

Previous Story